In this tutorial, you will learn how to setup Paypal for non-profit.

Paypal allows you to create a non-profit account associated with your charity that you can use to receive donations and discounted transfers. First, it is worth to mention that Paypal asks for a letter from the IRS statin g your tax-exempt status as a charity and a bank statement or a voided check in the name of your non-profit organization along with your email. Once you have gathered these documents, you have to send them to compliance@paypal.com and wait for a confirmation of their processing. After you are greenlit by Paypal, the registration process is the same, except that you cannot register as a business.

In the following moments, we will show you how to find out more about Paypal’s non-profit accounts, about the discounted rates you can have as non-profit, and also how to create donation buttons for your charity’s website.

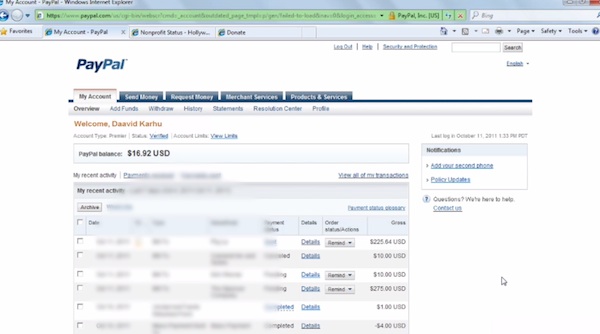

Step 1:

Log in to your Paypal account and go to “Merchant Service”s.

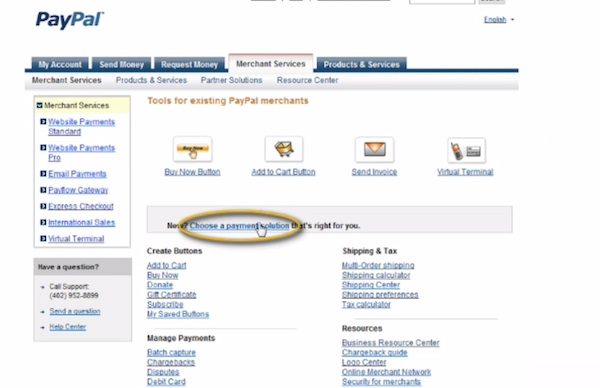

Step 2:

Click on “choose a payment” solution and scroll down to the bottom of the page.

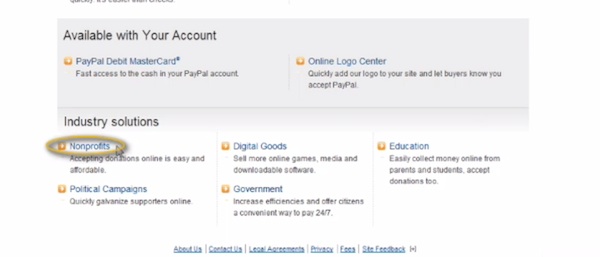

Step 3:

You will see a section called “Non-profits”. Click on it. Paypal presents you with a full package of information for your charity.

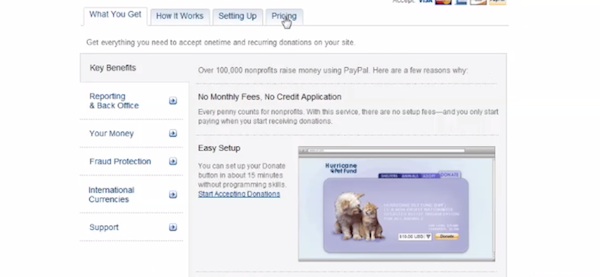

Step 4:

Click on “ Pricing”. Here are the fees that you can have as a non-profit in the Paypal system.

Step 5:

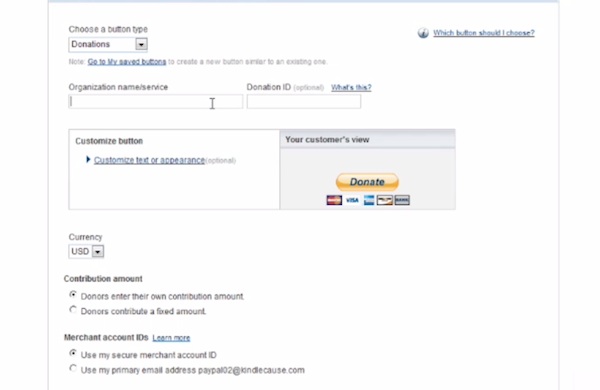

Let’s see now how we can create donation buttons for your charity organization. Again, from the Merchant Services tab, select Donate from the Create Buttons menu. Type in the name of your charity and all the other information you want to present to your donators. You can save your button on the Paypal website for later use if you want.

Step 6:

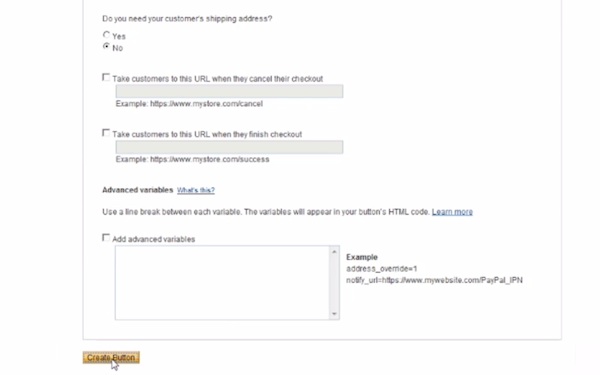

Click “Create” button.

Step 7:

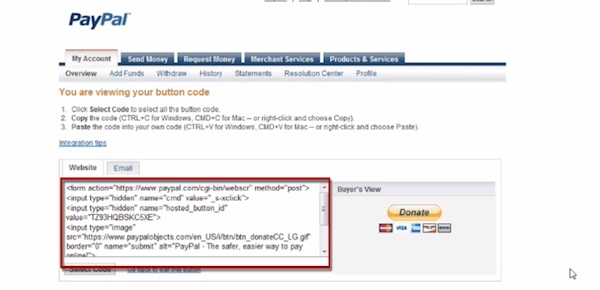

Your code is generated and you can copy-paste it into your charity’s website. It will look exactly like the one on the right.

Results: Congratulations! You have learned how to set up and use Paypal for non-profit.

Home

Home